What is a Third Party Motor Insurance?

Did you ever have a careful look at your motor insurance policy document? There are two parts in which the premium is divided. One being the Own Damage Premium and the other being the Third-Party Premium. With this post today we will learn more about third party insurance.

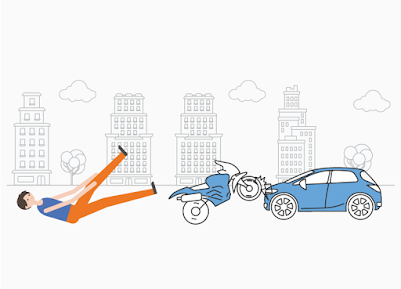

A third party insurance policy as the name suggests is one that covers the third party which has suffered damages due to your vehicle. So, if you accidentally hit someone on the road and the person or his vehicle suffers damage then he can claim damages from you which will be payable by your insurance provider. The third-party insurance covers you of the legal liability for damages that you owe to a third person because you caused an accident.

Legal requirement

Third-party insurance is the bare minimum insurance that your vehicle should have. It is a legal requirement to have third party insurance for your vehicle. Not having one is considered a violation of the law and can lead to a fine if the vehicle gets checked by cops. It has to be taken into account that third-party insurance doesn't cover you for the damages to your vehicle, for that, you need full insurance that covers the own damage portion along with the third party insurance also called a comprehensive insurance policy.

Standard rates fixed by IRDA

Also, unlike comprehensive insurance policy where different insurers may charge different rates, in third-party insurance, the rates are decided by the insurance watchdog, the IRDA, and are reviewed annually. The rates are based on the types and engine classification of vehicles and remain standard across insurance companies.

Whether you should opt for comprehensive cover or third-party cover only?

Third-party insurance is very cheap compared to a comprehensive cover. While the choice to take a comprehensive cover or a third-party cover is solely on you but it is advisable to have a look at the vehicle condition, average distance covered annually, and vehicle aging before deciding which cover to take. For new cars, one should definitely go for the comprehensive cover but for cars which are old and are not in a very great condition one can opt-in for third party cover. The reason for this is that in case of an accident a lot of damages may not be covered because of the condition of the car before the accident.

How feasible is the claim process if you are the third party?

Suppose your car has been damaged by another car. In this case, you are legally entitled to claim damages caused to you by the first party. But the good news ends here itself.

To get a claim for third party insurance is a cumbersome and lengthy process. For this, an FIR has to be registered and a case has to be filed in a special court by the aggrieved party (you in our example). The case settlement takes 1-5 years post which you get your damages. Also, the extent of damages and whether you will get damages or not depends on the verdict of the court. So, in case of an accident even if caused by someone else's negligence, it is advisable to keep your comprehensive policy in hand so that you can visit your service centre and claim for damages from your own policy. In the case of a death claim, one's nominee may follow the legal route to get the damages.

Can you upgrade your cover to comprehensive?

If by reading this article you have second thoughts about not getting a comprehensive cover and are unsure if you will be able to opt for it ever now then don't worry. One can upgrade their insurance policy from third-party to comprehensive. Just wait for the renewal date and take a quote for comprehensive cover. It has to be noted that in the case of upgrade the insurance company may appoint a person to physically inspect the vehicle before upgrading the cover as the company seeks to protect itself from damages that are already caused to the vehicle. In case of an accident, any pre-existing damage won't be reimbursed by the insurance company.

Third-party insurance in real life serves limited usage and is treated more as a legal requirement. However, in case someone suffers physical injury or dies in an accident then the claim for damages can be huge which will be covered by your insurance. So, it is advisable to have this insurance always with you.

To get your latest insurance quote contact us at finriseinvestment@gmail.com or +91-8568953926.

👍👍

ReplyDelete