Choosing the best bank account for your kid!

There was a time when one used to get his own personal bank account either post the age of 18 or at the time of their first job. Opening your first bank account is a memorable event because that marks your formal entry into the monetary system. You get equipped with cards & cheque books and have the right to transact anywhere in the world with the help of banking instruments. A few years ago bank accounts were thought to be a privilege that only salaried and businesspeople could enjoy. For others, it was often thought that if you don't have any income then what will you do with a bank account!

But times have changed now. Today, more than 80% of Indians have a bank account. This massive influx of bank accounts has led to a change in the lifestyle as well as thinking of an average Indian household. Banks are looked upon as a store of value where money can be kept safely while offering liquidity just like physical cash. Money kept in the bank isn't vulnerable to hazards like damage & theft. Banks have taught the people the art of saving and investing money. It is said that till the time you don't have your skin in the game you don't learn anything. A bank account acted as the skin in the game where people put their hard-earned money and learned the art of savings.

So many changes have come in these times that today financially aware parents get the bank accounts for their kids opened at a very young age. At FinRise, we often get client queries who want to start SIP for their kids as to which bank should they open their kid's account in. So, we decided to note down the various accounts being offered for minors by different banks and highlight common features as well as differences.

But first, let us discuss the merits of opening a bank account for kids. Often we see people who get their first salary are unaware of how to invest their money. It is because they have not been introduced to the concept of money and banking from early on. Opening a banking account for your kid will introduce him to the concept of money and savings from the right age so that he doesn't end up investing money in the wrong instruments. In short, a bank account acts as a teacher for your kid. The money is safer in a bank account rather than a piggy bank. Also, one can keep a large amount of money in a bank account. The kid can track the performance of money and can learn the essential concept of interest rate. A Bank account acts as a separate saving jar which the parents might use to segregate money from their savings specifically for their kid's future. The features of having a bank account for your kid are immense. Let's directly see what we found out when we analyzed various banks offering minor accounts.

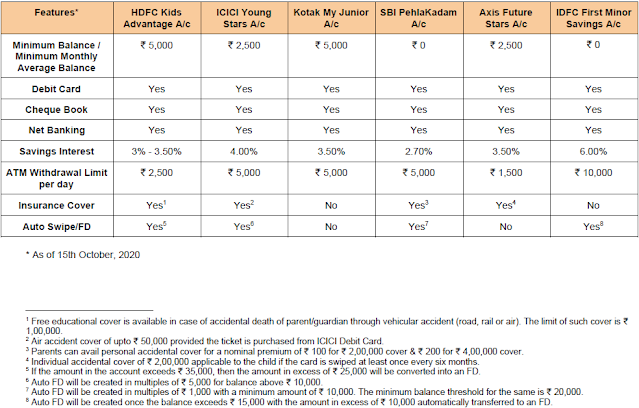

- The minimum balance requirements are different across banks.

- All banks offer standard features like debit card, cheque book, and internet banking.

- Interest on the savings account balance is similar across banks.

- ATM cash withdrawal limit varies with IDFC offering the highest limit of Rs. 10,000 per day.

- Different types of insurance facilities are provided as a complimentary feature by some banks.

- Banks also offer Auto FD feature where balance above a particular limit automatically gets converted into an FD.

We hope that this post clears a lot of your doubts with regards to opening a bank account for your special one. By the way, have you started an SIP in the name of your child? If no then contact us and start investing for a bright future for your child! Reach us on finriseinvestment@gmail.com or +91-8568953926.

Comments

Post a Comment